What is a

‘What’s Next Call’

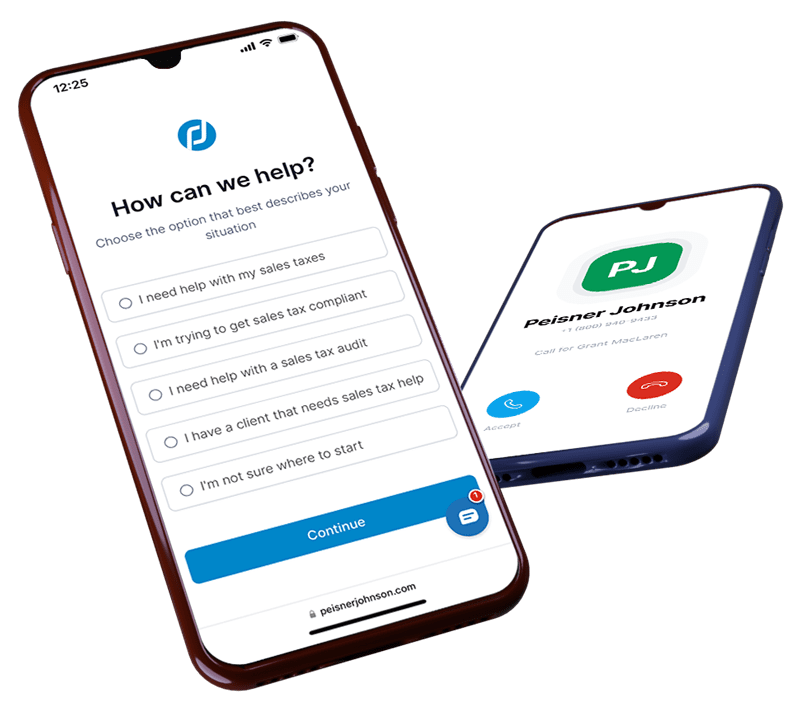

One of the most common questions we are asked on consultations with taxpayers is, “What do I do next?”

First off, it’s Free

You can’t ignore sales tax without consequence. So, we make sure everyone can afford to find answers by making our ‘What’s Next Calls’ completely free.

Real humans & Real experts

You will talk with a real sales tax expert that will provide real-time solution options. Our people are our secret sauce. And with 30+ years of experience, they know their stuff.

We are here to help

This is a no-pressure call – a consultative discovery call. We learn about you and your specific situation so we can help you get answers and obtain sales tax compliance.

What will we talk about?

We can cover a variety of topics on a ‘What’s Next Call’, it really depends on your specific situation, but here are the main points we focus on.

Established Nexus

Which states and jurisdictions have you triggered nexus in?

Product/service taxability

What does your business do or provide, and how is that taxed?

Registrations vs VDAs

Secure compliance by registering or mitigate potential past liability.

Effects of sales tax neglect

What happens to you and your business if you are not sales tax compliant?

Your compliance options

Identify and communicate strategies to get and remain sales tax complaint.

Your sales tax history

What have you encountered in the past and what can be done?

White glove service options

What can The Sales Tax People do to alleviate sales tax compliance anxiety

Finding peace of mind

Reclaim confidence that your sales taxes are handled.

Get the help you deserve

If you’re going to be responsible to collect sales tax, it will be important to be accurate, and there are hundreds of state, city, and county jurisdictions that all have their own tax law determining the taxability of your products and services. So, getting and remaining compliant can be quite complex. We offer services to both determine your Nexus, and the taxability of what you sell. Together we can help you understand where you should register, and on what sales you should collect tax.

We strive to cultivate a no-pressure environment in these ‘What’s Next’ calls. Ultimately, we just want you to have the peace of mind that comes from knowing what your options are regarding sales taxes. We’re perfectly happy if you leave this call educated, but don’t need our help. We believe when you help others, you help yourself. We over Me.

We strive to cultivate a no-pressure environment in these ‘What’s Next’ calls. Ultimately, we just want you to have the peace of mind that comes from knowing what your options are regarding sales taxes. We’re perfectly happy if you leave this call educated, but don’t need our help. We believe when you help others, you help yourself. We over Me.

Ready to schedule your ‘What’s Next’ Consultation?

Whether you need help with a current audit, aren’t sure if you’re over or underpaying state and local taxes, or if you're just into sales tax talk, we've got you covered. A sales tax expert can help you find the right solution to help you get compliant.

Claim your Free Sales Tax Consultation worth $500!