State and local sales tax support

Whether you're an ecommerce seller looking to understand nexus, or a CPA introducing SALT to your practice, access to the right tax support can make a huge difference. The below resources will help build expertise in state audits, Wayfair, automation and more.

What we do

Sales Tax Support

At Peisner Johnson, we're dedicated to providing comprehensive support and expert services to help businesses, CPAs, marketplace facilitators, sellers, and e-commerce entrepreneurs navigate the complex world of sales tax compliance. Our range of services is designed to assist you at every step of your sales tax journey.

CPAs & Accounting Firms

For accounting professionals looking to enhance their sales tax knowledge and help clients achieve compliance, our tailored solutions provide the guidance and support you need.

Learn more

Marketplace Facilitators & Sellers

Our specialized expertise in marketplace facilitator laws and e-commerce sales tax compliance ensures you meet your obligations without unnecessary stress.

Learn more

Sales Tax Audit Help

Facing a sales tax audit? We've got you covered with audit defense services that help you navigate the audit process smoothly.

Learn more

eCommerce Tax Consulting

E-commerce businesses have unique sales tax challenges. We offer expert guidance to ensure your online sales are tax-compliant.

Learn more

Sales Tax Automation

Simplify the sales tax process with our automation solutions, reducing the risk of errors and penalties.

Learn more

Support for everyone

At Peisner Johnson, our commitment to a 'We Over Me' mentality drives us to assist anyone, even if it means offering support without expecting immediate returns. We believe in sharing our knowledge and expertise to create a community of successful, compliant businesses and professionals.

30k+

Projects completed

100M+

Sales tax saved

30+

Years of experience

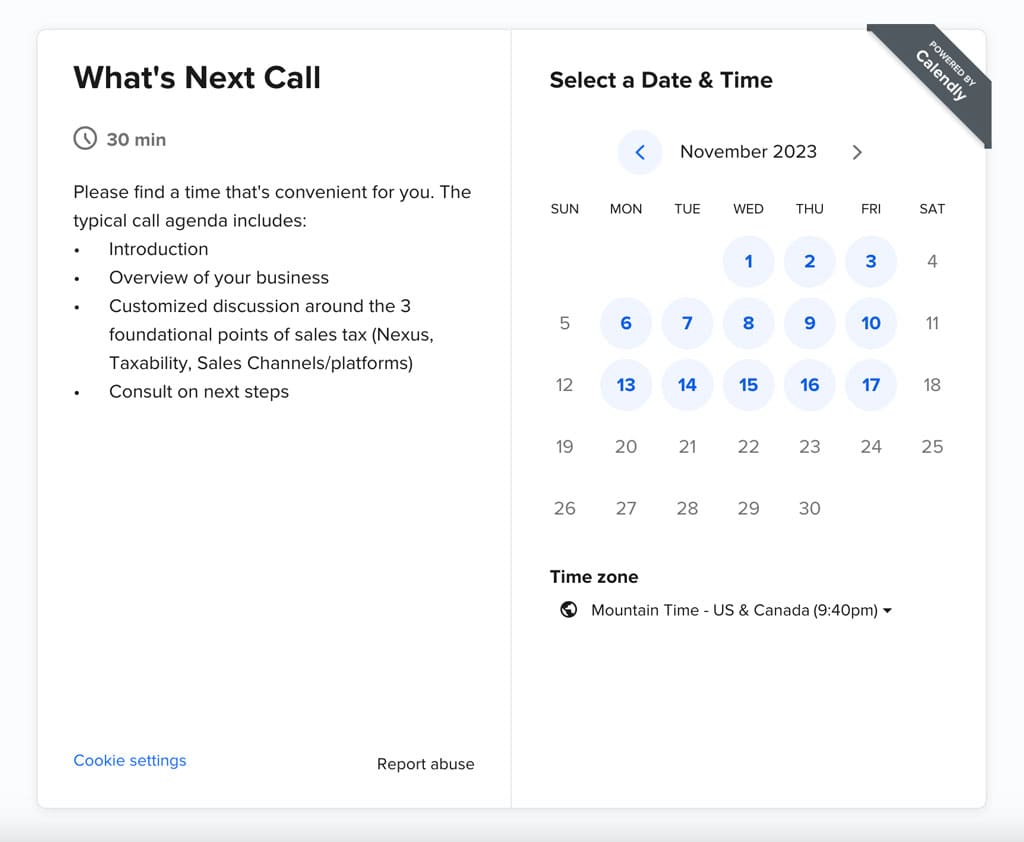

Schedule your free “What’s Next’ call

Tailored Support: No matter where you are in your sales tax compliance journey, our team is here to support you. We provide customized solutions to address your unique needs and challenges.

Expert Consultation: Schedule your free "What's Next" call with us today for expert guidance, advice, and answers to your sales tax questions.

Long-Term Partnership: Whether you need a one-time consultation or are seeking a long-term partnership, we're ready to assist you on your journey to sales tax compliance.

Claim your Free Sales Tax Consultation worth $500!