Sales Tax Audit Help

When it comes to being audited for sales and use tax, it's a question of "when," not "if." And when it happens, you need sales tax audit help.

Audit cost

Impact of an audit

Most executives and business leaders understand that businesses get audited for sales and use tax, but only a small percentage are aware of the material impact to their company should a state auditor come knocking on their door.

Industry operation

A sales tax audit occurs when a state agency inspects the books and records of a company. Specifically, they’ll evaluate the correctness of sales tax paid on invoices and use tax accrued on invoices. Sales tax paid on invoices can occur in two areas:

Sales tax paid on invoices for company purchases

Sales tax charged and collected on invoices from sales

Our audit resources found below will assist you in handling the audit and in keeping the assessment to a minimum. We do not advocate evading taxes that are legally due and we don’t see auditors as your enemy or ours.

We understand the sales tax audit process thoroughly. Through our experience in handling hundreds of audits, we know how state auditors work. We’ve worked for companies with revenues of less than $1 million to companies with revenues over $100 billion. We’ve saved our clients over $61 million in audit assessments. That means our clients were over assessed in the first place by $61 million.

It should come as no surprise that state auditors aren’t looking for companies that are managing their taxes correctly. After all, audit penalties and assessments provide enormous revenue and help shore up budget deficits. According to a recent California State Board of Equalization (BOE) in a 2013-2014 report, the state generated over $21 million in revenue from their managed audit program.

It should come as no surprise that state auditors aren’t looking for companies that are managing their taxes correctly. After all, audit penalties and assessments provide enormous revenue and help shore up budget deficits. According to a recent California State Board of Equalization (BOE) in a 2013-2014 report, the state generated over $21 million in revenue from their managed audit program.

Sales tax audit

Audit Resources

We compiled a stellar guide to help you understand and navigate an audit. Click on one of sequential chapters here, or download full PDFs below.

Understand how to successfully navigate your audit

Download your free audit guides today.

Opportunities for the state

Targeted industries

Certain industries tend to put themselves at risk of an audit in two ways.

Industry operation

Businesses such as bars, restaurants, grocery and liquor stores are all cash-based businesses. And auditors are all too aware that cash goes unreported. However, while cash-based businesses routinely put themselves in compliance risk, the effort to find the errors might be too high for many auditors to even bother investigating, especially if it’s a small operation.

Historic evasion

Some industries have a high concentration of historic misalignment to regulations. This may lead auditors to target these certain industries. State and local sales and use tax laws are complex and ever-changing. It takes internal accounting and finance teams a ton of research and due diligence to keep up with and keep their company compliant.

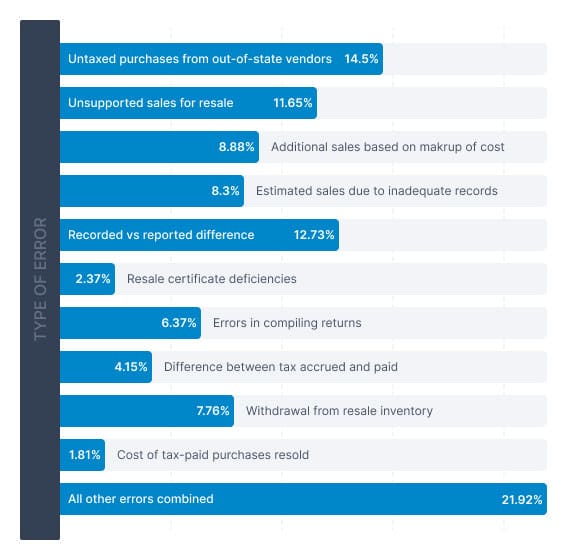

Top Ten Areas of Errors Found Upon Audit

There are many ways a company can make a mistake in their compliance, but as the data from the California BOE indicates, the following account for the majority of errors.

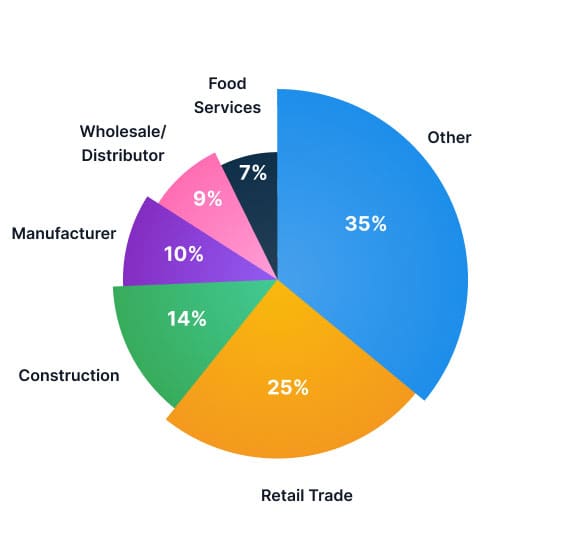

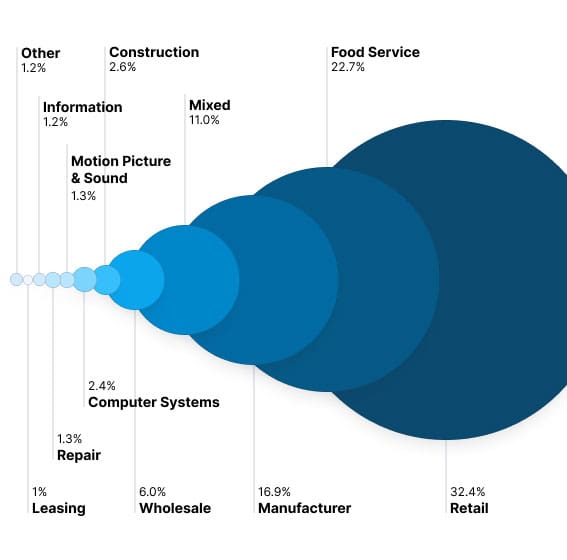

% of Audit Assessments Collected by Industry Class

In the 2013-2014 fiscal year (according to the CA BOE report), the top three industries found to have large assessments were Retail, Food Service, and Manufacturing.

Top Industries Under Audit in Texas

Interestingly, the data told a slightly different story in Texas. While retail and manufacturing remained high, like California, Texas also targeted the construction industry and wholesale/distributors.

Top Ten Areas of Errors Found Upon Audit

There are many ways a company can make a mistake in their compliance, but as the data from the California BOE indicates, the following account for the majority of errors.

% of Audit Assessments Collected by Industry Class

In the 2013-2014 fiscal year (according to the CA BOE report), the top three industries found to have large assessments were Retail, Food Service, and Manufacturing.

Top Industries Under Audit in Texas

Interestingly, the data told a slightly different story in Texas. While retail and manufacturing remained high, like California, Texas also targeted the construction industry and wholesale/distributors.

Top Ten Areas of Errors Found Upon Audit

There are many ways a company can make a mistake in their compliance, but as the data from the California BOE indicates, the following account for the majority of errors.

% of Audit Assessments Collected by Industry Class

In the 2013-2014 fiscal year (according to the CA BOE report), the top three industries found to have large assessments were Retail, Food Service, and Manufacturing.

Top Industries Under Audit in Texas

Interestingly, the data told a slightly different story in Texas. While retail and manufacturing remained high, like California, Texas also targeted the construction industry and wholesale/distributors.

Don't tackle a sales tax audit alone

Let's talk today to see how we can keep money in your business.

Claim your Free Sales Tax Consultation worth $500!