If you’re using a sales tax automation software service provider, it’s important to be aware of potential risks. In this post we will explore how to avoid costly mistakes and ensure compliance with sales tax regulations by following best practices and recommendations.

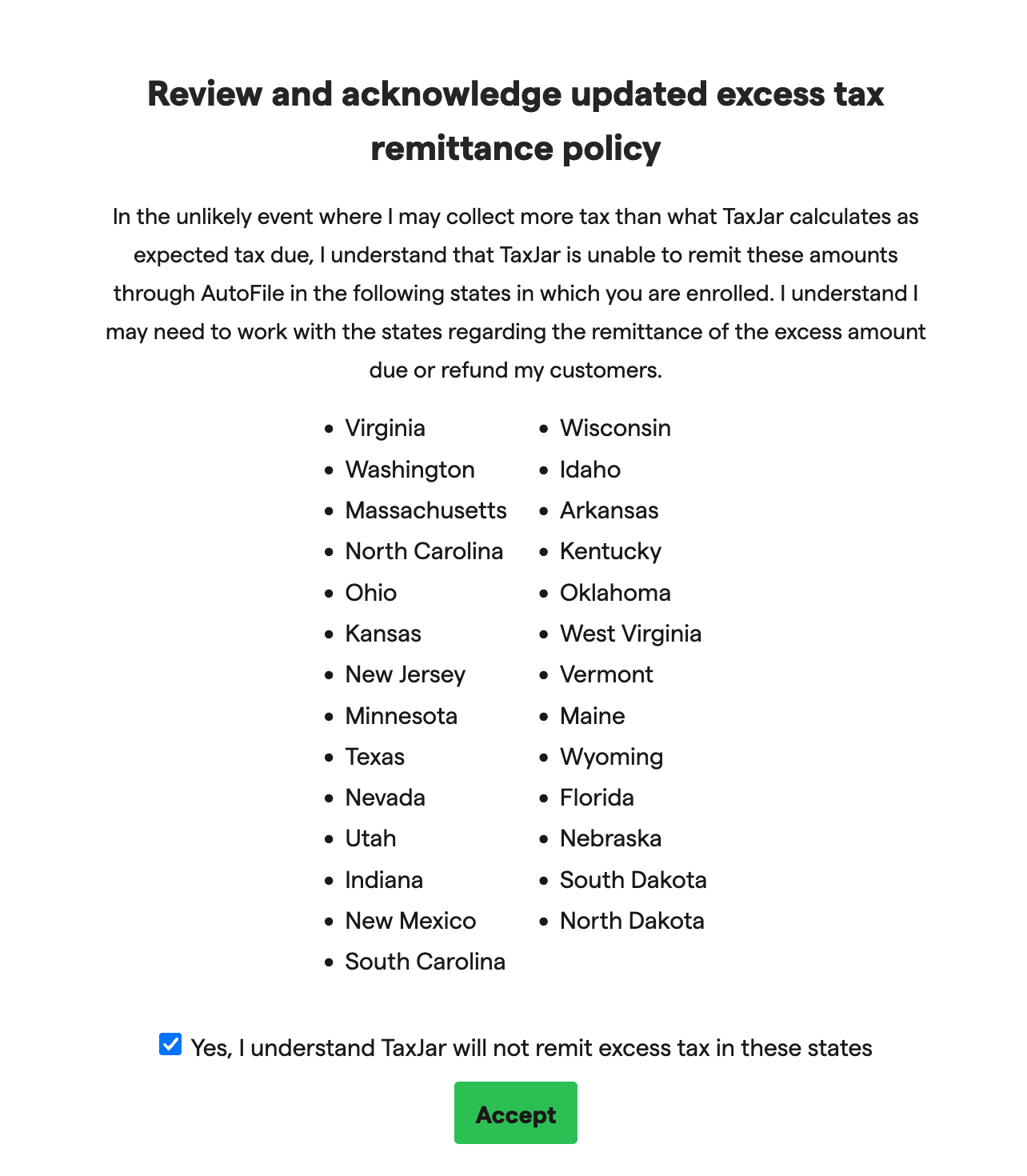

Picture this. You open an email from your sales tax automation provider, it reads:

As you scan the list of states you realize, this applies to you and you are left feeling confused and nervous about your sales tax compliance. This is a real-life scenario we’ve seen clients go through with their sales tax automation software.

Let’s start out by stating the obvious; automating parts of the sales tax process can be necessary to maintain compliance. However, automated systems are most effective when the process to follow is clear-cut. Unfortunately, the sales tax process is seldom clear-cut and is typically ambiguous and nuanced.

Overall, in the unlikely event that your automation software collects tax but doesn’t remit it, it’s your responsibility to figure it out and get compliant. While this may feel off-putting, there are ways to mitigate and become compliant. This is not the time to bury your head in the sand and ignore it.

Ultimately, sales tax that’s been collected but is unremitted is NOT a good thing. If your automated software solution is not submitting the collected tax to the appropriate tax authorities, it is still the responsibility of your business. Your business could become overwhelmed by the burden of penalties and non-compliance which can be a hard thing to come back from.

At first glance, this may seem like an injustice. But when all is said and done, the business is responsible for ensuring that taxes are properly collected and remitted. Even if they have hired a third party service to handle the process. Bottom line: it’s your responsibility to ensure your sales tax process is working.

While automation seems like a straight-forward and uninvolved solution, there are inconsistencies and gaps that you need to take into account. These limitations can include (but aren’t limited to):

Software solutions may present the illusion that you are saving money and providing a simple solution to a complicated problem. And yet, if it is not managed closely it can cost your business all that money you are “saving” along with additional liability, penalties and fees. It can lead to errors and failed returns.

At the end of the day, it takes a sales tax expert to give you peace of mind around sales tax. While automation may apply the right rate and make the right determinations, you still need an expert to monitor and ensure proper compliance. When you approach automation as a supportive tool to the sales tax process paired with sales tax professionals you find you get the best of both worlds. If you have questions regarding automation, peace of mind is a “What’s Next Call” away.

We care about your data — privacy policy.